Who Owns MEDITECH? MP's Trustee Role Tests Jamaica's Ownership Disclosure Law

SUBSCRIBER CONTENT

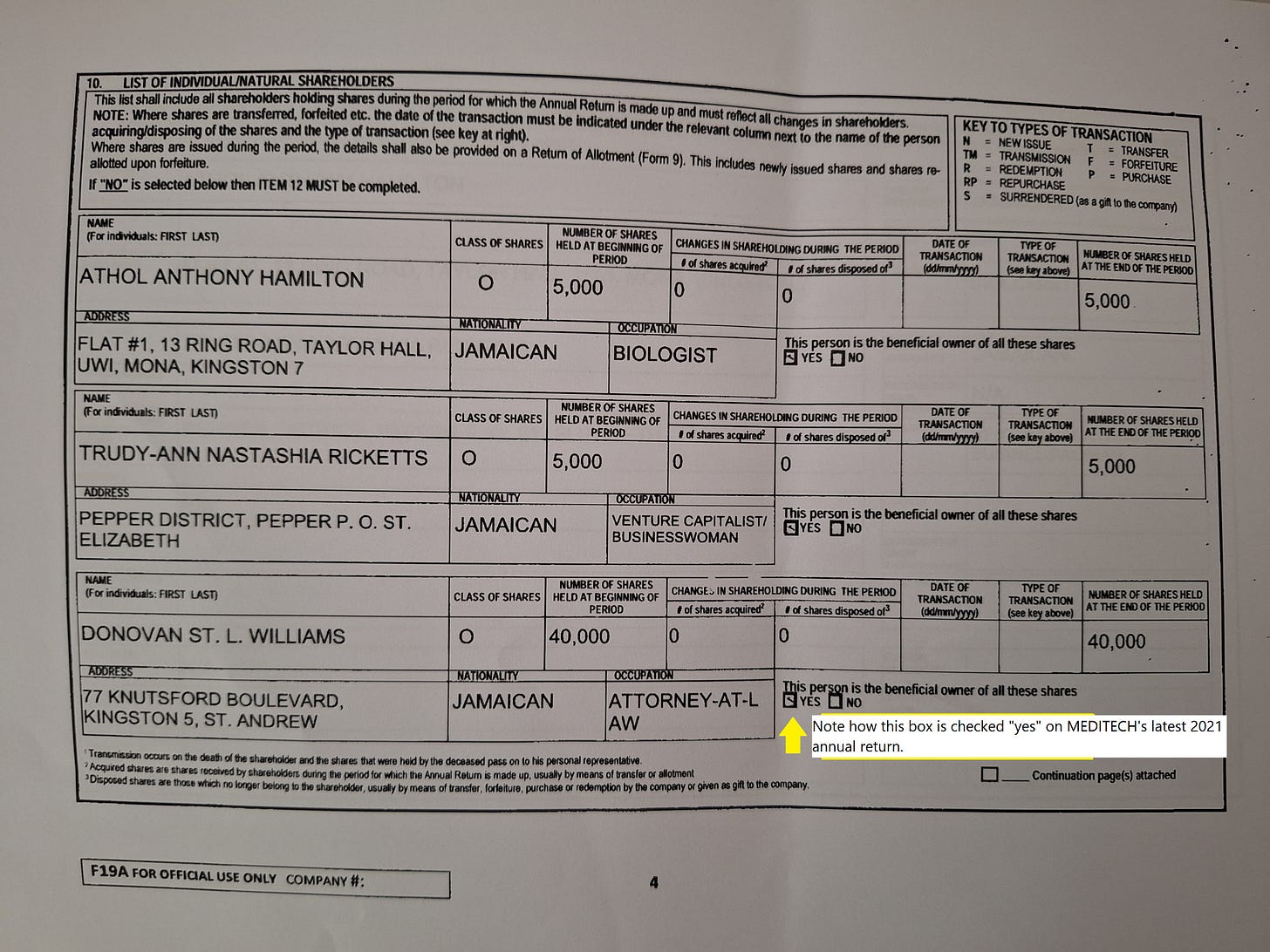

The revelation that Kingston Central Member of Parliament Donovan Williams is the trustee shareholder of 40,000 of Medical Technologies (MEDITECH) Ltd.’s 50,000 issued shares has raised questions over the real ownership of the company, which is at the center of a $31.5 million (US$200,151) neurosurgical drill controversy.

The revelation came to light at a May 20 press conference by Opposition Spokesperson on Health Dr. Alfred Dawes, who accused the firm of overcharging the Jamaican government for the drill made by U.S. manufacturer Medtronic — a claim over which he is now being sued.

Williams subsequently issued a statement claiming he was only “trustee” of the shares in his other capacity as an attorney and doesn’t share in the company’s profits. He said that following the resolution of a shareholder dispute in 2022, arrangements were made to facilitate transfer of the shares to the real owner - who he didn’t name - though as of July 7, 2025, he is still listed as the shareholder. The other two shareholders owning 5,000 shares each from the company’s inception in 2007 are Athol Hamilton and Trudy-Ann Ricketts, who are also listed as the company’s directors. Neither Hamilton, Ricketts, nor Williams would answer questions about the company.

2016 MEDITECH shareholder dispute

In a 2016 lawsuit filed against MEDITECH and Williams in Jamaican court, previously-listed shareholder Winfield Boban, an American, claimed he had given Williams the 40,000 shares in 2009 to hold in trust.

Boban, a former Medtronic regional manager directing sales in the Caribbean and Latin America between 1999 and 2005, declined to comment on the lawsuit’s outcome, and the court told 18° North the case is sealed.

Complicating matters is that MEDITECH and Williams secured an injunction to conceal the identity of a silent partner who had provided financial backing. According to the ruling that secured the injunction, MEDITECH had argued that it is on behalf of that person — known only as “Person A” in the court document — that Williams owns the 40,000 shares.

The ban on nominees

The murkiness of MEDITECH’s ownership is precisely the kind of opacity the amendments to Jamaica’s Companies Act in 2023 were trying to eliminate. At the prodding of the global financial watchdog, Financial Action Task Force (FATF), these reforms were aimed at greater transparency around company ownership to help combat money laundering and terrorist financing.

*Section 23A of the Companies Act now states, “No company incorporated under this Act shall have a nominee shareholder,” and section 172(1A) states: “No company incorporated under this Act shall appoint a nominee director.”

Though these terms aren’t defined in the principal Act and there are no listed penalties, 18° North sent an email to an attorney from the Companies Office of Jamaica asking, "If an attorney is saying they are a trustee for shares today, isn't that prohibited as a result of the section of that Act now or can you still be a trustee for shares for a Jamaican company?"

The attorney, who didn’t want to be named, responded: "Yes your example is correct that arrangement is prohibited." However, when asked if MEDITECH was therefore in breach of the Companies Act, she didn’t respond.

The issues with nominees

Nominees have traditionally been used to front for the real owners of companies usually for privacy reasons or convenience, and are usually paid a fee.

However, following the 2016 Panama Papers leak that exposed how some nominees had been used to obscure the identity of alleged tax dodgers, money launderers or persons involved in other criminal activity, there was a global push for company transparency.

Video: An old report by 18° North journalist Andre Huie in Nevis, where the use of nominee directors raised red flags, underscoring the dangers of leaving company ownership opaque.

In Jamaica, Keith Darien of the Financial Investigations Division attests that nominee setups without knowing who the beneficial owner is “complicates and frustrates the work of financial crime investigators to recognize proceeds of crime to trace ill-gotten gains and to eventually have those assets forfeited.”

Now, under the new law, not only are nominee shareholders and directors for Jamaican companies outlawed, but a beneficial ownership return must also be filed, revealing individuals who hold at least 25% of shares or exert ultimate control over the company or its management.

Opposition Leader Mark Golding supports nominee use

It was the addition of the beneficial ownership return and it being applied to a broad swath of companies that helped Jamaica get off FATF’s Grey List, which had previously hurt the credibility of the country’s financial system globally.

However, despite the new filing requirement, the beneficial ownership information is available only to certain authorities and procuring entities—not to the public. The ban on nominee shareholders bridged that gap, ensuring that listed shareholders are the true owners—or at least face scrutiny if they aren’t.

But rather than cheering on these amendments, Opposition Leader Mark Golding, who is also a corporate attorney, opposed the ban on nominee shareholders when the changes were tabled on March 28, 2023, three days before the deadline for it to be passed on March 31, 2023. He argued that the bill was being rushed to meet FATF requirements without proper thought and that requiring disclosure of beneficial ownership made the ban unnecessary.

Golding explained, while revealing that he was asked to make representation by a leading company law attorney, that nominees can serve legitimate functions in helping manage companies for people who live abroad or outside of Kingston. “It is a question of commercial convenience that these arrangements be facilitated,” he said.

A snippet from a video curated by PNP with Mark Golding’s presentation when the amendments to the Companies Act were tabled in 2023.

In a later clarification, Golding acknowledged to 18° North on July 3, 2025 that when he spoke in 2023, he wasn’t aware that the beneficial ownership information wouldn't be open to the public. While he says he supports making that public, he still defends the use of nominee shareholders, spelling out that they can represent minors or those with intellectual disabilities, and, in a commercial context, they can also hold shares as collateral to secure obligations owed by the real shareholder to a third party, and even serve as an escrow agent for the real shareholder, pending the outcome of a future event.

Why did Boban transfer the shares to be kept in trust?

Boban told 18° North the reason he transferred his 40,000 shares to Williams in 2009 was so he could act on his behalf because “I wasn’t living in Jamaica at the time.”

It’s not clear why that would have been necessary since he had listed a Texas address when first registering as a MEDITECH shareholder in 2008—suggesting he may have already been living abroad.

Additionally, when Boban ceased being a director in 2009, he didn’t also transfer his directorship to Williams and, in fact, “remained as CEO until the year 2013,” according to a statement later sent by his attorney to 18° North.

Asked whether his decision to make Williams trustee was because of an issue with his then U.S. employer listed on his LinkedIn profile — which was in the business of biologic products and was later bought by Medtronic — Boban said, “Madam We have already spoken. You are putting my life in danger. Please stop.”

Asked why he said that, he didn’t respond.

MEDITECH’s compliance issues

Companies Office records show that, since its 2021 filing, MEDITECH hasn’t submitted any new annual returns, which is how shareholder changes are usually reported.

Oddly, on that annual return, Williams is marked as the beneficial owner of the shares, which was how such information for companies with shares used to be reported prior to 2023, when filing a separate form became mandatory. As of July 7, 2025, MEDITECH hasn’t filed that mandatory beneficial ownership return either.

Penalties for not filing a Beneficial Ownership Return

According to sections 377F and 377I of the amended Companies Act, once nine months have passed from the due date of the beneficial ownership return, the Companies Office is supposed to issue a notice to the company, and, during this time, the directors can’t borrow on behalf of the company and the members of the company can't transfer their shares. If the company doesn’t comply within 30 days, the Companies Office should write again giving the company an additional 60 days to comply. Failure to submit the documents then could result in the company being struck off the register and the company being dissolved. Financial penalties could also apply. (MEDITECH has already racked up $36,000 (US$229) in late filing fees.)

But despite MEDITECH seemingly being in breach of the amended company law, the Companies Office said on June 10, when asked, that it hadn’t commenced compliance action against the company and didn’t explain when asked why not.

However, 18° North has since seen a Companies Office letter from that same date requesting that MEDITECH file its overdue returns, though it made no mention of Williams’ public acknowledgment about being a trustee shareholder. The Companies Office also made clear this letter wasn’t sent under section 377F of the Act. When asked why not it would only say: “We use the different provisions for compliance in the Act and we have not yet used 377F for this company.”

Lackadaisical approach by regulators

This lack of proactive oversight and enforcement by the Companies Office raises a question about whether Jamaica is serious about compliance and whether this blasé approach by the country’s regulators could put Jamaica’s hard-won gains with FATF at risk?

In a statement released on May 22, Opposition Spokesperson on Justice Senator Donna Scott-Mottley called for immediate enforcement of the Companies Act; suspension of all government contracts with non-compliant entities; and full disclosure of MEDITECH’s beneficial owners.

“The public deserves transparency, not taxes funnelled to shadowy figures or political insiders,” she said.

But since the amended company law prohibits public disclosure of the beneficial owners by the Companies Office, it’s not clear how MEDITECH’s true ownership would be disclosed unless the Companies Office enforces the nominee ban and forces the company to update its records with the real shareholder.

Failing that or failing to get an investigation from an accountability body like the Integrity Commission - which Dawes has called for - might mean MEDITECH’s beneficial ownership information will remain private.

Will there be a rollback of ownership disclosure reforms?

As time goes by, the window for getting this information might also close.

Maurene Simms, Jamaica’s lead contact for FATF and chair of the National Anti-Money Laundering Committee, recently revealed to 18° North that the nominee ban was always meant to be temporary as the Companies Office didn’t devise safeguards to regulate nominees safely in time for the bill’s passage in 2023, and now proposed amendments are in the works for nominee shareholders to be put back in the framework with the right controls.

Despite Simms describing the proposed amendments as “advanced,” efforts by 18° North to get a copy of the changes have so far proved futile with the Companies Office stating, “they become public when the bill is being debated.”

If passed, that could mean that corporate lawyers, like Golding, would get their way, and potentially, once again, legally obscure for the public the real identity of shareholders.

####

Editor’s Notes:

Editing help by ChatGPT.

The exchange rate used is J$157.22:US$1, the average sell rate on the Bank of Jamaica website for 2024.

*Though sections 23A and 172(1A) of the Companies Act explicitly prohibit nominee shareholders and nominee directors, there are other references to nominees in the Act that weren’t changed in the 2023 amendments. As a result, at least one legal mind has suggested to 18° North there are legal ambiguities around the use of nominees even today. To those references, the Companies Office said, “The prohibition is the law now. These arrangements would have to be up dated to adhere to the prohibition.”