Updated: Jamaica’s Finance Minister Dr. Nigel Clarke Pushed For Stronger Non-Profit Oversight While Several Organizations Linked To Him Were Non-Compliant

Politicians and Their Delinquent Non-Profits

SUBSCRIBER CONTENT

For the past several years, Jamaica’s Finance Minister Dr. Nigel Clarke has been the ministerial point person on addressing deficiencies in the nation’s anti-money laundering and counter-terrorism financing regime.

It’s all in an attempt to comply with 40 recommendations that were imposed by the global standard-setter for money laundering and terrorist financing rules, Financial Action Task Force (FATF), which placed Jamaica on its international grey list in February 2020.

One of the deficiencies he’s been addressing is supervision of the non-profit sector.

The regional arm of FATF, called the Caribbean Financial Action Task Force (CFATF), which monitors the progress of regional countries, found that although Jamaica had a legal framework for registering and obtaining information from non-profits, the system was “not risk based,” which means that it didn’t implement enhanced measures for charities that are vulnerable to financial crimes like terrorist financing.

But while pushing for stronger oversight of charitable organizations, several non-profits linked to Dr. Clarke were delinquent on their filings at the nation’s regulatory bodies for multiple years, which would undermine the ability of regulators to supervise the sector. One of them has been outstanding on its filings for as many as 13 years.

The Delinquent Non-Profits Founded By Dr. Clarke

The non-profits linked to Dr. Clarke include Growth & Opportunity Trust Ltd., which he founded the year he was elected a member of parliament in 2018 to help the citizens of his North Western St. Andrew constituency. He also founded National Youth Orchestra of Jamaica Ltd. (NYOJ) in 2009 to promote music and the performing arts, particularly among inner-city Jamaicans. There’s also the UWI Regional Endowment Fund Ltd. (UWIREF), where he was a director from its inception in 2008 and whose purpose is to provide an independent source of funding for university programs outside of government grants and student tuition.

All three organizations took the first step of registering as a non-profit at the Companies Office of Jamaica, but only Growth and Opportunity and NYOJ took the second step and also enrolled at the charities authority called the Department of Co-operatives and Friendly Societies (DCFS), which made them charities in the true sense and gave them tax-exempt status. UWIREF is merely a company with a charitable purpose.

With each registration at each government entity, annual returns and financial statements have to be filed each year, plus a tax return must be submitted to the Tax Administration of Jamaica (TAJ).

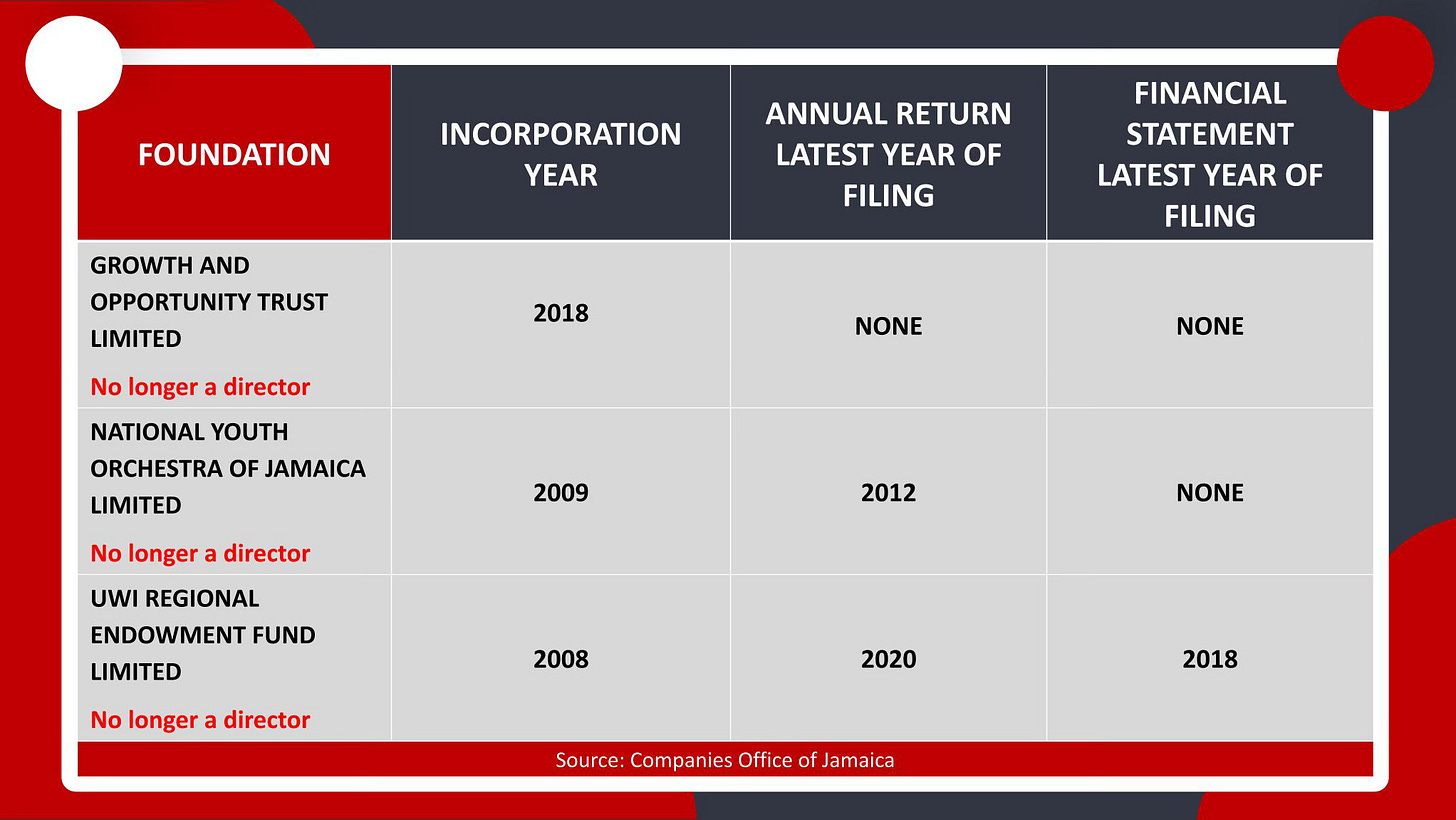

But when 18º North checked at the Companies Office in Summer 2022, Growth and Opportunity had never made a filing there since its inception in 2018. Annual returns for NYOJ were outstanding for nine years from 2013 – 2021, and no financials were on file. UWIREF had not filed an annual return there since 2020. Its last recorded financial statement was 2018.

At DCFS, checks made in January 2023 revealed that Growth and Opportunity had only that month filed its 2021 returns, which would have been after 18º North had made contact with Dr. Clarke about the delinquencies. The last set of returns on file for NYOJ were for 2016. DCFS said NYOJ’s registration had lapsed.

Even at TAJ, over which Dr. Clarke presides as minister, checks beginning late in 2022 show that no filings had ever been made for Growth and Opportunity. We weren’t able to get information on UWIREF and NYOJ from that department, which belatedly cited privacy.

Reached by phone in January 2023, Dr. Clarke tried to dodge responsibility for the late filings by claiming that he was no longer a director of any of the organizations.

However, for most of the periods that were outstanding, Dr. Clarke was either the chairman or a director of each organization, and all three had still failed to file. Additionally, for Growth and Opportunity Trust, while company documents confirm that Dr. Clarke ceased being a director effective February 2020, two months later in April 2020, while standing on the stage with Prime Minister Andrew Holness, he still referred to it as “our” then “my foundation” on national television as he pledged the Jamaican equivalent of US$2,000 to the Covid-19 telethon. (Dr. Clarke clarified to 18º North in another conversation on June 22 that the use of the word “our” was a mistake and that PM Holness has nothing to do with Growth and Opportunity Trust.)

After making contact with Dr. Clarke, filings for Growth and Opportunity were brought up to date at the Companies Office, and it was only outstanding at TAJ for the latest year, based on a visit to that entity on May 7, 2024. (On June 22, Dr. Clarke said the organization is now fully up-to-date at all three entities, but we couldn’t confirm that at DCFS and TAJ.)

UWIREF filed some of the required paperwork at Companies Office, but filings are still outstanding for three years. And even though Dr. Clarke said he discontinued his service to UWIREF more than a decade ago and the entity conceded to 18º North in January 2023 that it had been operating on the premise that Dr. Clarke was no longer a director, the paperwork it filed with the Companies Office in March 2023 removing him as a director was with effect Feb. 1, 2022, a much more recent date.

NYOJ has still not filed any annual returns since 2013 at Companies Office and no financial returns since 2010, both periods when Dr. Clarke was its chairman. This means that NYOJ has now been delinquent for 13 years, and Dr. Clarke was on the board up until 2018. The Companies Office said notices were sent to NYOJ in 2012 and 2016, but it didn’t give a reason as to why the non-profit was allowed to still be on the company rolls. Without addressing the delinquencies at Companies Office, Dr. Clarke wrote in a WhatsApp to 18º North on June 22 that while NYOJ had submitted the annual filings with the DCFS from 2009 to 2016, “My understanding is that NYOJ has not been active since the pandemic in 2020 and my further understanding is that the new board is working on updating any outstanding filings.” Reached on WhatsApp, the board member handling the matter confirmed, “We will definitely be updating the filings in order to restart activities.”

Why Are The Filings Important?

The initial failure of the three foundations to file is indicative of a bigger problem in Jamaica of non-compliance in the non-profit sector.

Around 70% of all registered non-profits in Jamaica didn’t fulfill their filing requirements for their 2021 annual returns or their 2020 financial statements at the Companies Office, based on an analysis by 18º North.

The filings are important because without them regulators can’t know who’s in charge of the organizations, where they’re based, how much money they raise and spend each year and who or what benefits from that money. Without that information, they can’t know which non-profits should be considered at-risk and therefore made subject to enhanced measures, as FATF is trying to achieve.

After a national review of the mechanisms Jamaica had in place for detecting financial crimes, the resulting report in 2021, known as the National Risk Assessment, found that although the country’s non-profit sector had a low risk of terrorism financing, money laundering was “more of a concern.”

It cited a case, widely believed to be that of Jamaica’s former Minister of Education Ruel Reid (though he was not named), who is accused of diverting over $50 million (US$333,333) of public funds for his personal use through a variety of schemes, including a non-profit organization established by his wife and daughter. They’ve all been criminally charged with corruption-related offences along with two others. Checks by 18º North in January 2023 revealed that the charity, the Education and Help Foundation, had never made any filings at the Companies Office, the DCFS nor at the TAJ since its inception in 2017. Attorney Carolyn Chuck declined to comment claiming the case is sub judice, which means that the case is currently before the court.

Charities Regulations Passed

The NRA stated that the investigation and ongoing prosecution of this case highlights the importance of “effective due diligence, tracking, recording and analysis of annual filings with the Supervisory Authority, and risk-based supervisory review.”

Since then, in December 2022, the Jamaican parliament, guided in part by Dr. Clarke, passed the Charities Regulations, which introduced risk-based supervision to guard against not just terrorism financing, as FATF wanted, but also against money laundering, which Jamaican regulators deemed a bigger risk for local charities.

Speaking in the Lower House at the time, Dr. Clarke explained that “certain financial institutions don’t want to deal with charities because these kinds of regulations are not in effect.” He further explained that if countries like Jamaica aren’t in line with international standards, “they’ll block your ability to access the financial system.”

Under these new Regulations, charities at an increased risk of being misused can be designated as “protected.” One of the criteria in the law that will be used to make this determination is whether the charity is connected to a politically-exposed person.

Once the charity is so designated, it would be subject to enhanced monitoring, which entails audits being carried out by the DCFS every year on those charities instead of every two years for other ones. Charities, in general, will also now have to file, in addition to their annual report and audited financial statement, the auditor’s report on the financial statements and on the use of donation monies, fundraising activities as well as expenditure plans for the next financial year.

Since the passage of the Regulations, over 40 charities have been deemed at-risk, but the DCFS didn’t respond to an email asking which charities were so designated. 18º North also looked on the department’s 2023 list of charities and noticed that all were rated either medium or low risk. Growth and Opportunity Trust and NYOJ linked to Dr. Clarke were both rated as medium risk, but DCFS didn’t respond when asked what that meant or what would now be done differently to monitor those charities.

Jamaica To Have More Reviews Even After Removal From FATF’s Grey List

Despite the passage of the new Regulations, Jamaica is still listed as only partially compliant with FATF’s recommendations to strengthen the non-profit sector as of the last CFATF evaluation dated December 2023.

Then, CFATF had announced that the country was compliant or largely compliant with 37 of the 40 recommendations—the outstanding items being: targeted financial sanctions related to proliferation; new technologies like cryptocurrency; and the non-profit sector.

Part of the issue is that though Jamaica succeeded in making the non-profit sector more risk-based, the country hasn’t yet applied to be re-rated on that prong by CFATF because it decided on its own that additional legislation is needed to ensure that all non-profits come under the authority of the Charities Regulations and be subject to this increased monitoring. Currently, only about a quarter of the 6,000 non-profits that have registered at the Companies Office have also registered at the DCFS, for example, meaning most of them would escape the new heightened level of scrutiny.

This ongoing compliance effort didn’t affect Jamaica’s ability to exit the grey list at the end of FATF’s plenary meeting last month in Singapore on June 28. The country is now firmly off it. Getting off the grey list was a priority for Dr. Clarke as being on it had subjected the country to a higher level of due diligence when transacting with international financial partners.

But Jamaica hasn’t been given the all-clear as the reviews are ongoing. The next round of evaluation, slated for 2026, will assess whether Jamaica is compliant with the three outstanding recommendations, including the non-profit sector.

In a recent address to parliament on the matter of FATF on July 9, Dr. Clarke pointed out that the international regulators aren’t just interested in the law on the books, but also their effectiveness.

But with several delinquent non-profits connected to him, one not having made a filing for 13 years, will international regulators be convinced that Dr. Clarke and Jamaica are serious about their commitment to monitoring non-profits more robustly for terrorism financing and money laundering?

####

Editor’s Notes:

This story has been updated from its original version to more precisely define Dr. Clarke’s links to the various non-profits; to insert the comment from the NYOJ board member; and to reflect that FATF has now taken Jamaica off its grey list.

*Exchange rate used for all calculations is J$150:US$1

With reporting by Zahra Burton and Isa Ridgard (Decd). Graphics by Shenelle Hanson.